The resources allocated to profit centers are intended to enable them to make strategic decisions, set prices, and manage costs to maximize revenue and profitability. On the other hand, revenue generation is a primary objective for profit centers, as their main focus is generating revenue and profits for the company. Profit centers have the authority and autonomy to make strategic decisions, set prices, and manage costs to maximize revenue and profitability. Cost centers, while not directly contributing to revenue, play a significant role in enhancing the overall efficiency of an organization. These units are often the backbone of operational support, ensuring that the essential functions of the company run smoothly. By focusing on cost management and operational excellence, cost centers help maintain a streamlined workflow, which is crucial for the productivity of profit-generating units.

Cost center:

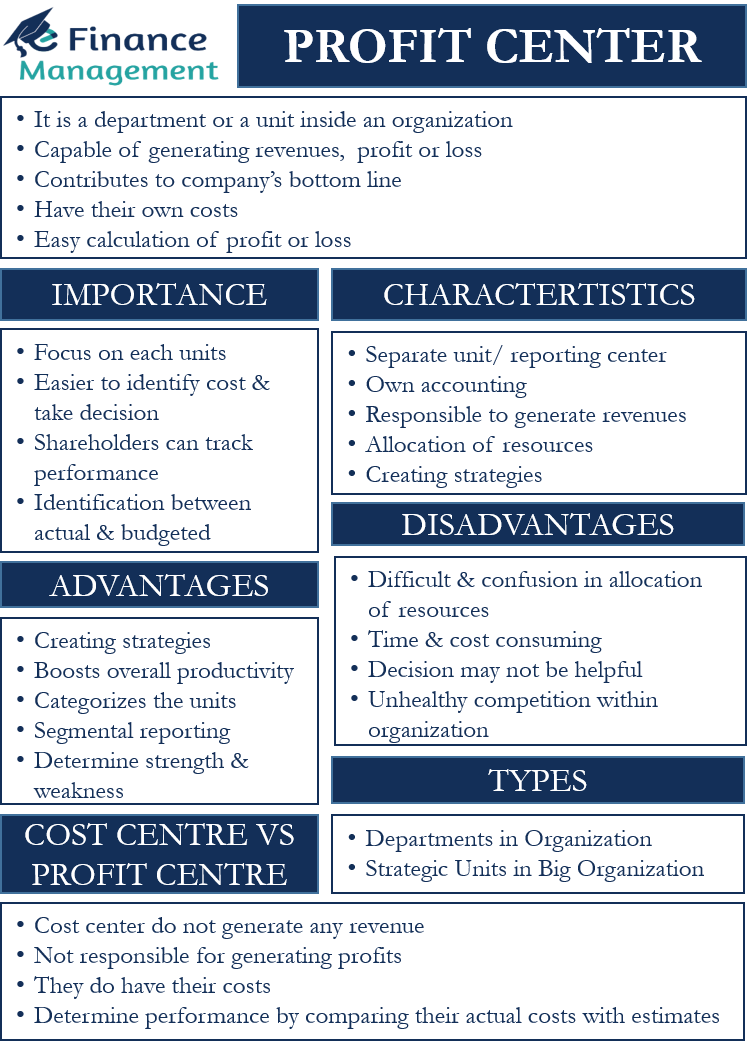

Meanwhile, profit centers are responsible for generating revenue and driving organizational profits. They are typically more focused on sales and marketing and may require additional resources to reserve accounting wikipedia generate revenue. Some examples of profit centers include product lines, business units, and divisions. The primary purpose of a profit center is to generate revenue and maximize profitability.

Authority of department heads

The key performance indicators (KPIs) for cost and profit centers differ significantly based on their primary objectives. Cost centers are typically evaluated based on their ability to manage costs effectively and efficiently. It is done through cost accounting, which involves tracking, analyzing, and allocating costs to different business units within the organization. Another important cost control mechanism is process optimization, which involves streamlining workflows to eliminate inefficiencies and reduce costs. Techniques such as Lean management and Six Sigma can be employed to identify waste and improve processes. For example, an IT department might use Lean principles to reduce the time and resources required for system maintenance, thereby lowering operational costs.

The Accountability in Cost Centers vs. Profit Centers – Notable Differences

Profit centers are evaluated based on their ability to generate revenue and profits for the company. Key performance indicators (KPIs) like revenue growth, gross margin, and net income typically serve as a gauge of their success. In the business world, organizations often use different management accounting techniques to track and evaluate their financial performance. While both play crucial roles in understanding and managing business operations, they differ in their objectives and functions.

- Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

- The centres where the firm undertakes production or conversion activities is production cost centres.

- A cost center is a reporting unit of a business that is responsible for costs incurred.

- Key performance indicators (KPIs) like revenue growth, gross margin, and net income typically serve as a gauge of their success.

- It is treated as a separate, standalone business, responsible for generating its revenues and earnings.

The management team focuses on minimizing expenses and increasing productivity, as their performance is evaluated based on how well they can manage costs. In addition, they are tasked with identifying cost-saving opportunities and implementing measures to reduce expenses. The primary objective of cost and profit centers is different, reflecting their distinct organizational roles. A profit center is a reporting unit of a business that is responsible for profits generated.

Its profits and losses are calculated separately from other areas of the business. It is important to monitor the performance of cost, profit and investment centres to judge how both the centres are performing economically and how their managers are performing as managers. It is important not to judge managers for elements of performance for which they have no responsibility. Unless the top-level management is aware of these issues and sets quality requirements properly, opportunities may be missed.

A cost center is a subunit (or a department) that takes care of the company’s costs. The primary functions of the cost center are to control the company’s costs and reduce the unwanted costs the company may incur. At the retailer Walmart, different departments selling different products could be divided into profit centers for analysis. For example, clothing could be considered one profit center while home goods could be a second profit center.

They provide visibility into the performance of individual business units or product lines, allowing management to allocate resources strategically and make informed investment decisions. Profit centers help organizations identify and nurture profitable areas, ensuring sustainable growth and competitive advantage. Cost centers and profit centers are two distinct concepts in business management that play crucial roles in financial analysis and decision-making. While both are essential for evaluating the performance of different business units, they have distinct attributes and serve different purposes.