A good example of the change in cost of a new technological innovation over time is the personal computer, which was very expensive when it was first developed but has decreased in cost significantly since that time. The same will likely happen over time with the cost of creating and using driverless transportation. Regardless of how contribution margin is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued.

Income Statement

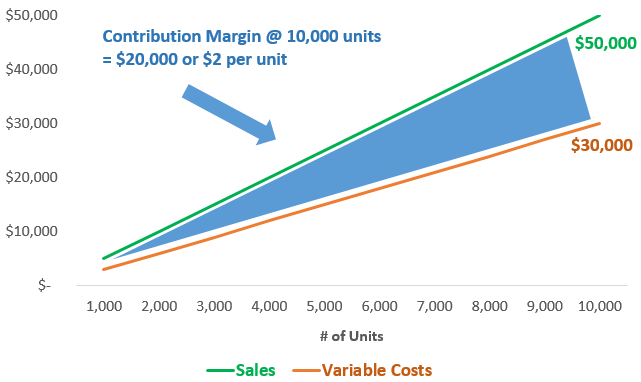

The contribution margin measures how much money each additional sale contributes to a company’s profits. Business owners generally use the contribution margin ratio on a per-product basis to determine the portion of sales generated that can contribute to fixed costs. And as we mentioned earlier, a negative margin indicates the cost of producing the product exceeds its revenue. Using this metric, the company can interpret how one specific product or service affects the profit margin. The fixed cost like rent of the premises, salary, wages of laborers, etc will remain the same irrespective of changes in production. So it is necessary to understand the breakup of fixed and variable cost of any production process.

How do you find the contribution margin per direct labor hour?

A company’s contribution margin is significant because it displays the availability of the revenue after deducting variable costs such as raw materials and transportation expenses. To make a product profitable, the remaining income after variable costs must be more than the company’s fixed costs, such as insurance and salaries. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low.

Contribution Margin Formula

Fixed and variable costs are expenses your company accrues from operating the business. In short, profit margin gives you a general idea of how well a business is doing, while contribution margin helps you pinpoint which products are the most profitable. A surgical suite can schedule itself efficiently but fail to have a positive contribution margin if many surgeons are slow, use too many instruments or expensive implants, etc. The contribution margin per hour of OR time is the hospital revenue generated by a surgical case, less all the hospitalization variable labor and supply costs. Variable costs, such as implants, vary directly with the volume of cases performed. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products.

Why You Can Trust Finance Strategists

You may also look at the following articles to enhance your financial skills. In this example, if we had been given the fixed expenses, we could also find out the firm’s net profit. Thus, here big four accounting firms we use the contribution margin equation to find the value. Contribution margin analysis is a measure of operating leverage; it measures how growth in sales translates to growth in profits.

What is the difference between the contribution margin ratio and contribution margin per unit?

However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range. Using this contribution margin format makes it easy to see the impact of changing sales volume on operating income.

Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. You work it out by dividing your contribution margin by the number of hours worked. That means $130,000 of net sales, and the firm would be able to reach the break-even point. We will look at how contribution margin equation becomes useful in finding the break-even point.

For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. The contribution margin can help company management select from among several possible products that compete to use the same set of manufacturing resources. Say that a company has a pen-manufacturing machine that is capable of producing both ink pens and ball-point pens, and management must make a choice to produce only one of them. On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. For a quick example to illustrate the concept, suppose there is an e-commerce retailer selling t-shirts online for $25.00 with variable costs of $10.00 per unit.

- Imagine that you have a machine that creates new cups, and it costs $20,000.

- Management uses the contribution margin in several different forms to production and pricing decisions within the business.

- However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases.

- To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers.

- These cost components should not be considered while making decisions about cost analysis or profitability measures.

Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. As of Year 0, the first year of our projections, our hypothetical company has the following financials.

The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc). The contribution margin is important because it gives you a clear, quick picture of how much « bang for your buck » you’re getting on each sale. It offers insight into how your company’s products and sales fit into the bigger picture of your business.

Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making.